India has rapidly emerged as a significant producer and consumer of biofuels, propelled by a combination of coordinated policies, strong political backing, and abundant feedstock resources. Over the next five years, the country has the potential to nearly triple both consumption and production by overcoming obstacles to higher ethanol blends and broadening the use of biofuels to replace diesel and jet fuel. However, attention must be paid to factors such as costs, feedstock sustainability, and the implementation of supportive policies for other biofuels besides ethanol.

India also has the opportunity to bolster global biofuel adoption through the Global Biofuels Alliance, initiated in 2023 with participation from leaders of eight other nations. The International Energy Agency (IEA) recently released a report titled “Biofuel Policy in Brazil, India and the United States: Insights for the Global Biofuel Alliance” to aid the development of this alliance. The report recommends a focus on expanding both existing and new markets, accelerating technology deployment and commercialization, and establishing consensus on performance-based sustainability assessments.

This commentary delves into the global biofuels landscape, India’s domestic potential, and the role of the Global Biofuels Alliance in accelerating sustainable biofuels usage worldwide. Over the next five years, biofuel demand is projected to surge by 38 billion litres, marking a nearly 30% increase from the preceding five-year period. Total biofuel demand is anticipated to rise by 23% to reach 200 billion litres by 2028, with renewable diesel and biojet fuel accounting for nearly half of this growth, alongside ethanol and biodiesel. Most of the new demand for biofuels is expected to emanate from emerging economies, particularly Brazil, Indonesia, and India, where robust biofuel policies, escalating transport fuel demand, and ample feedstock potential drive expansion. While advanced economies like the European Union, the United States, Canada, and Japan are enhancing their transport policies, biofuels growth is hampered by factors such as increasing electric vehicle adoption, vehicle efficiency enhancements, technical limitations, and elevated blending costs in certain markets. Renewable diesel and biojet fuel emerge as primary growth segments in these regions.

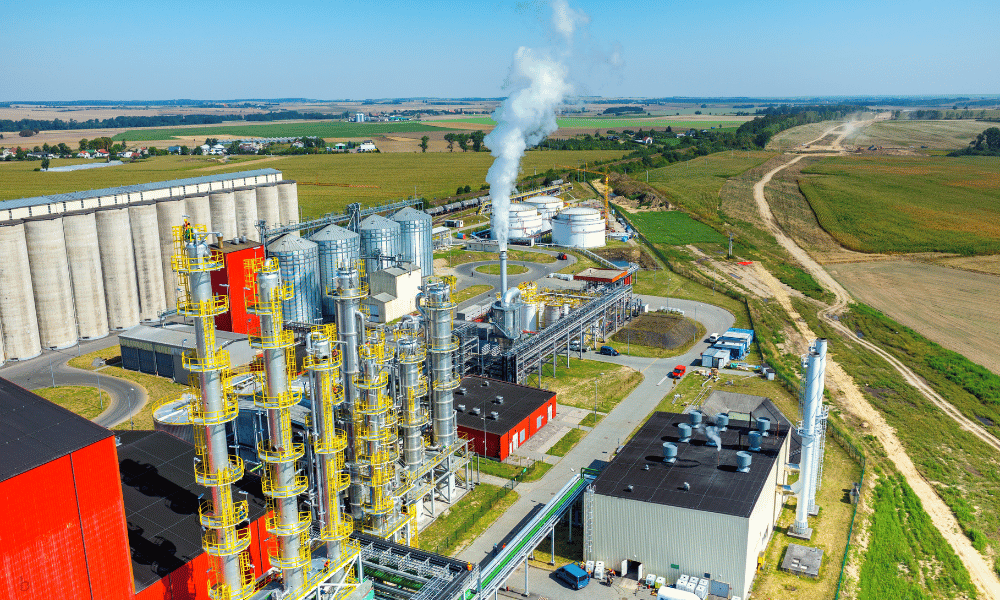

India currently ranks as the world’s third-largest producer and consumer of ethanol, owing to a nearly threefold increase in production over the past five years. The country harbours further potential for expansion with appropriate policies aimed at cost containment and securing sustainable feedstocks. The National Policy on Biofuels, released in 2018, established blending targets for ethanol and biodiesel, along with measures such as guaranteed pricing, long-term contracts, and technical standards. The government’s move to advance the 20% volume blending target for ethanol to 2025-26 underscores its commitment to biofuel adoption. To achieve the 20% ethanol blending target across India, efforts are underway to expand the fleet of vehicles capable of accepting higher ethanol blends, including the promotion of flex-fuel vehicles and retrofits for older vehicles. Additionally, implementing greenhouse gas measurement and reporting requirements would enhance transparency and drive improvements in emissions reductions from biofuel use in the transport sector. Diversification of feedstocks is also crucial to mitigate supply shortages, with initiatives such as the establishment of cellulosic ethanol plants contributing to this endeavour. India also has opportunities to scale up biodiesel production for diesel vehicles and biojet fuel as a substitute for conventional jet fuel. The government’s target of achieving a 5% biodiesel blend by 2030 necessitates policies similar to those for ethanol, including production support, guaranteed pricing, and feedstock assistance, particularly for mobilising residue oils like used cooking oil and vegetable oils from marginal land. The burgeoning biojet fuel market presents another growth avenue, with indicative blending targets set for international flights departing from India. This initiative is poised to drive demand for biojet fuel, likely sourced from residue or vegetable oils cultivated on marginal land. Future growth prospects could also stem from alternative technologies such as alcohol-to-jet and gasification, facilitating the conversion of agricultural, forestry, and municipal solid waste into jet fuel.

In conclusion, biofuels play a pivotal role in transitioning away from fossil fuels, complementing efforts in electric vehicle adoption and vehicle efficiency enhancements. They offer compatibility with existing vehicles and contribute significantly to emissions reduction in long-distance road, air, and maritime transport. Despite their potential, the world is currently not on track to meet the ambitious targets outlined by the IEA’s net-zero scenario. However, concerted efforts at both national and international levels, coupled with supportive policies and technological advancements, can propel the biofuels sector toward a sustainable and low-carbon future.

In the IEA’s accelerated scenario, bolstering existing policies, setting new targets, and expanding biojet fuel usage result in a doubling of annual historical growth rates to 8% through 2028.Nearly half of this augmented growth, amounting to 29 billion litres of new demand, stems from reinforced policies in established markets like the United States, Europe, and India (for ethanol), with an additional 21 billion litres arising from emerging markets (biodiesel in India and ethanol in Indonesia). Biojet fuel emerges as a third avenue of growth, projected to cover almost 3.5% of global aviation fuels – a significant increase from the 1% in the main case.

Nevertheless, even with this level of growth, it falls short of a net-zero scenario. To align with a net-zero trajectory, biofuels production from new processing technologies accessing a vast agricultural and forestry residue base must quintuple by 2030, requiring substantial developmental support as most technologies remain in the pre-commercial stage. To address GHG emissions intensity, technologies like CCUS applied to biofuel projects can effectively reduce emissions with lower feedstock demand. Additionally, biofuel production needs to significantly expand beyond the dominant players of the United States, Brazil, Europe, and Indonesia. In all instances, predictable long-term policies with clear sustainability requirements are imperative to minimize uncertainty and stimulate investment.